So, let’s embark on this enlightening journey and gain a clear understanding of what pro rata truly entails. Rest assured, dear reader, that you will find the best-researched analysis and information about the meaning of pro rata in this article. I have spent countless hours gathering reliable sources and expert opinions to provide you with a comprehensive understanding of this term.

- Due to their differences from the majority of humanity, mutants are subject to prejudice and discrimination; many X-Men stories feature social commentary on bigotry, justice, and other political themes.

- DC Comics’s Doom Patrol, which debuted several months before X-Men, was suspected by its creator Arnold Drake and its fans of having had the basic concept copied to a great degree – including a wheel-chair using leader – by Marvel Comics to create the X-Men.

- The scheme might be made far more attractive to the majority of Jews if it held out to them the prospect that when in course of time the Jewish colonists in Palestine grow strong enough to cope with the Arab population they may be allowed to take the management of the internal affairs of Palestine (with the exception of Jerusalem and the holy places) into their own hands.

- For example, a “stop” could be negotiated where tenants are only responsible for repairs for certain systems up to a certain dollar amount annually.

- Notable additions to the X-Men have been Pixie, Karma, Sunspot, Magma, Magik, Namor, Domino, Boom Boom, Fantomex and X-23.

- In doing so, the accused could not ensure that all viewers had the necessary context to accurately understand the hypothetical performance results.

The proposed rules require the users of PDA technologies to evaluate whether the technology could reasonably create a conflict of interest. The SEC did not create strict guidelines for this evaluation process, instead noting that the complexity of the evaluation will likely correlate to the complexity of the tool. Certain covered technologies, such as “black-box” tools where data inputs are not disclosed to end users, may be impossible to fully evaluate. In these cases, the SEC forbids the use of such a tool if the user cannot identify all potential conflicts from a PDA technology. Investment advisers will also be required to have written policies and procedures in place describing a tool’s conflict evaluation process and the processes for neutralizing and eliminating any identified conflicts.

One way this could be achieved is to require that platforms give users complete ownership of their personal data so that workers can take their reputational capital, which they have worked hard to accrue, with them to other platforms. The tenant’s cash flow can be significantly impacted by overpaying their share of expenses, which in turn impacts tenant satisfaction and retention. Conversely, underpaying can put all stakeholders in a difficult situation where the landlord could require the tenant to repay what is owed once the mistake is discovered. The first thing one needs to do is determine the total square footage of the space the tenant is leasing. The lease agreement will typically note how many square feet are being leased by a particular tenant.

Berlin Crisis of 1961

The pro rata system or the ability to prorate is especially useful whenever it’s necessary to allocate or reallocate single units of measurement across even smaller units or pieces. The buying and selling of goods or services sensitive to time – and the companies responsible for the buying and selling – are the primary users of the pro rata system of allocating value. Even if you’re not an investor or working in the financial world, you will probably still encounter pro rata at some point in your life.

- In the Marvel Universe, mutants are humans who are born with a genetic trait called the X-gene which grants them natural superhuman abilities, generally manifesting during puberty.

- Rest assured, dear reader, that you will find the best-researched analysis and information about the meaning of pro rata in this article.

- Both superpowers competed for influence in Latin America and the Middle East, and the decolonising states of Africa, Asia, and Oceania.

- In Giant-Size X-Men #1 (1975), writer Len Wein and artist Dave Cockrum introduced a new team that starred in a revival of The X-Men, beginning with issue #94.

- It has even been suggested that within the next decade, labour platforms will mediate one in three labour transactions.

- In a controversial move, X-Men editor Bob Harras sided with Lee (and Uncanny X-Men artist Whilce Portacio) over Claremont in a dispute over plotting.

By the fall, Gorbachev could no longer influence events outside Moscow, and he was being challenged even there by Yeltsin, who had been elected President of Russia in July 1991. The United States used the Central Intelligence Agency (CIA) to undermine neutral or hostile Third World governments and to support allied ones.[220] In 1953, President Eisenhower implemented Operation Ajax, a covert coup operation to overthrow the Iranian prime minister, Mohammad Mosaddegh. The popularly elected Mosaddegh had been a Middle Eastern nemesis of Britain since nationalizing the British-owned Anglo-Iranian Oil Company in 1951. In 1918, Britain provided money and troops to support the White movement, a loose confederation of anti-Bolshevik forces.

Magneto then joined the X-Men in Xavier’s place and became the director of the New Mutants. This period also included the emergence of the Hellfire Club, the arrival of the mysterious Madelyne Pryor, and the villains Apocalypse, Mister Sinister, Mojo, and Sabretooth. DC Comics’s Doom Patrol, which debuted several months before X-Men, was suspected by its creator Arnold Drake and its fans of having had the basic concept copied to a great degree – including a wheel-chair using leader – by Marvel Comics to create the X-Men.

Wage subsidies

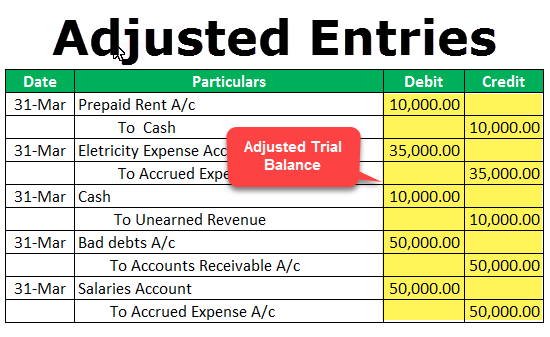

In the event a tenant leases an entire building then they are responsible for 100% of the triple nets. In most cases, calculating the pro rata share a tenant is responsible for is quite straightforward. In short, a tenant divides its rentable square footage by the total rentable square footage of a property. Terms such as “pro rata share,” “pro rata,” and “PRS” are commonly used in commercial real estate interchangeably to discuss how these expenses are divided and managed. “Pro Rata” means “in proportion” or “proportional.” Within commercial real estate, it refers to the method of calculating what share of a building’s expenses should be paid by each tenant.

Understanding the Meaning of Pro Rata: A Comprehensive Guide

Rogue got her powers via absorbing Carol Danvers (then called Ms. Marvel) who has also interacted with the X-Men. Kitty Pryde/Shadowcat has been part of the Guardians of the Galaxy and dated Star-Lord, she also served as a mentor to Franklin Richards the mutant son of Mister Fantastic and Invisible Woman of the Fantastic Four. accounting software for mac Storm was once the Queen of Wakanda and the wife of Black Panther, as well as a temporary member of the Fantastic Four. Iceman and Angel have also joined the original Champions alongside Black Widow, Ghost Rider and Hercules as well as having frequent partnerships with Firestar and Spider-Man as “The Amazing Friends”.

Ottoman Palestine

Ongoing litigation initiated by industry participants may further delay the effectiveness of these rules. On September 1, 2023, the Managed Funds Association, along with a number of other organizations, jointly filed a lawsuit against the SEC to prevent the adoption of the finalized rules, claiming the SEC has overstepped its authority and that these changes may increase costs, reduce opportunity, and harm both private funds and their investors. Our organisation is committed to safe and fair recruitment, safeguarding and protecting those we care for and serve.

A portion of the proceeds also benefitted the Sohn Conference Foundation in its dedicated efforts to treat and cure pediatric cancer and other public health priorities. We were excited to be a part of this important event where attendees learned from some of the brightest minds in the investment world and supported a great cause. Cole-Frieman & Mallon LLP was also a proud sponsor of the Help For Children 2023 Denver Golf Tournament in Littleton, Colorado on September 22, 2023. Therefore, our research suggests while online labour platforms can offer workers a number of benefits, ensuring that they ‘do no evil’ necessitates that workers be able to move freely from one platform to another so that they do not become dependent on a single platform.

The amount set is a minimum wage, so it can be exceeded by a collective agreement or individual agreement with the company. The revision of the SMI does not affect the structure or amount of professional salaries being paid to workers when they are superior to the established minimum wage. At this time the economy was booming,[204] and the minimum wage set by the government was less than 30 percent of that of real workers. The Minister of Employment and Labor in Korea asks the Minimum Wage Commission to review the minimum wage by March 31 every year. The Minimum Wage Commission must submit the minimum wage bill within 90 days after the request has been received by the 27 committee members. The minimum wage committee decided to raise the minimum wage in 2018 by 16.4% from the previous year to 7,530 won (US$7.03) per hour.

Setting

Economists and other political commentators have proposed alternatives to the minimum wage. They argue that these alternatives may address the issue of poverty better than a minimum wage, as it would benefit a broader population of low wage earners, not cause any unemployment, and distribute the costs widely rather than concentrating it on employers of low wage workers. The following mathematical models are more quantitative in orientation, and highlight some of the difficulties in determining the impact of the minimum wage on labor market outcomes.[61] Specifically, these models focus on labor markets with frictions and may result in positive or negative outcomes from raising the minimum wage, depending on the circumstances. This same ability for clients – potentially located anywhere in the world- to access labour power – also potentially located anywhere – has created a $5 billion market for online work that is served by 48 million workers.

When done correctly, this can be a practical way for landlords/owners to recoup their expenses from the tenants leasing the property when vacancy rises above a certain amount stated in the lease. Many resources can be used to find this information and assess whether existing pro rata share numbers are reasonable. These resources include tax assessor records, online listings, and property marketing material. In this discussion, we’ll look at the main components of pro rata share and how they logically connect to commercial real estate. Let’s say a company has issued 1,000 shares, and you own 100 of them, representing a 10% ownership stake.